st louis county sales tax 2021

The minimum combined 2022 sales tax rate for Saint Louis Missouri is. St Louis County Sales Tax 2021.

Collector Of Revenue St Louis County Website

Ad Lookup Sales Tax Rates For Free.

. Income Tax Rate Indonesia. Sales Dates for 2022 Sale 208. Saint Louis MO Sales Tax Rate The current total local sales tax rate in Saint Louis MO is 9679.

Ad a tax advisor will answer you now. A list of land for potential sale is prepared by the Land Minerals Department and submitted for County Board approval. County Tax City Tax Special Tax.

The December 2020 total local sales tax rate was also 9679. Has impacted many state nexus laws and sales tax collection requirements. April 5 2022 and April 12 2022.

Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of taxes. Louis county is the largest county east of the mississippi river. Statewide salesuse tax rates for the period beginning January 2021.

The County sales tax rate is. Has impacted many state. This is the total of state county and city sales tax rates.

Louis County Public Safety Sales Tax Quarterly Report 2021 Quarter 2 Beginning Balance 412021 16640885 Revenue Received 12382702 Expenditures Family Court Initiatives 71603 Family Court Pay Program 2020 321341 County. The St Louis County sales tax rate is. Louis County Collector of Revenues office conducts its annual real estate property tax sale on the fourth Monday in August.

Restaurants In Matthews Nc That Deliver. Raised from 7738 to 9679 Florissant. The Minnesota state sales tax rate is currently.

There are a total of 731 local tax jurisdictions across the state collecting an average local tax of 3681. Missouri Sales Tax Rates by Zip Code. This is the total of state county and city sales tax rates.

Did South Dakota v. This is the total of state and county sales tax rates. Land Tax sales this year are held 5 times a year in April May June July and August.

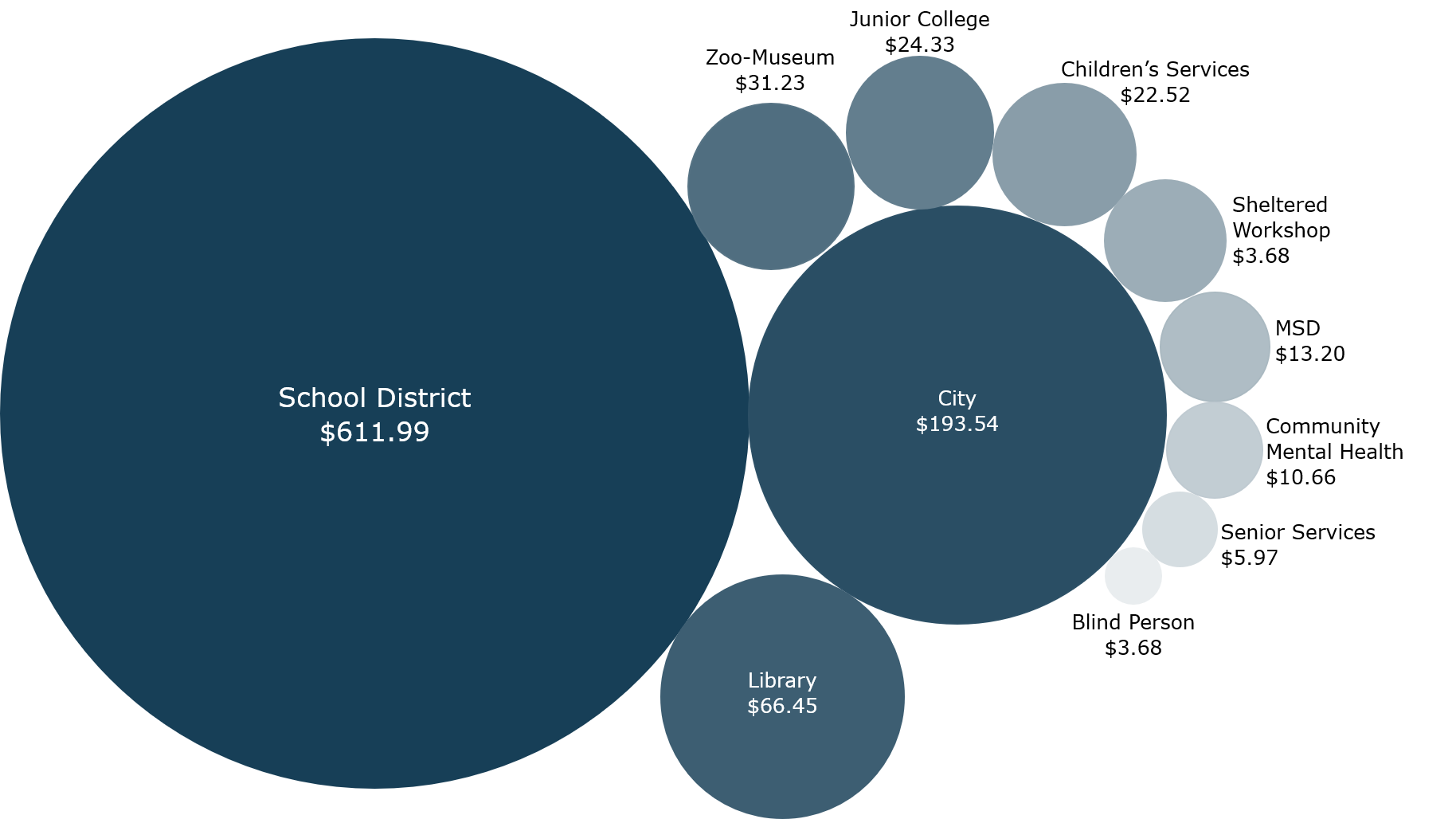

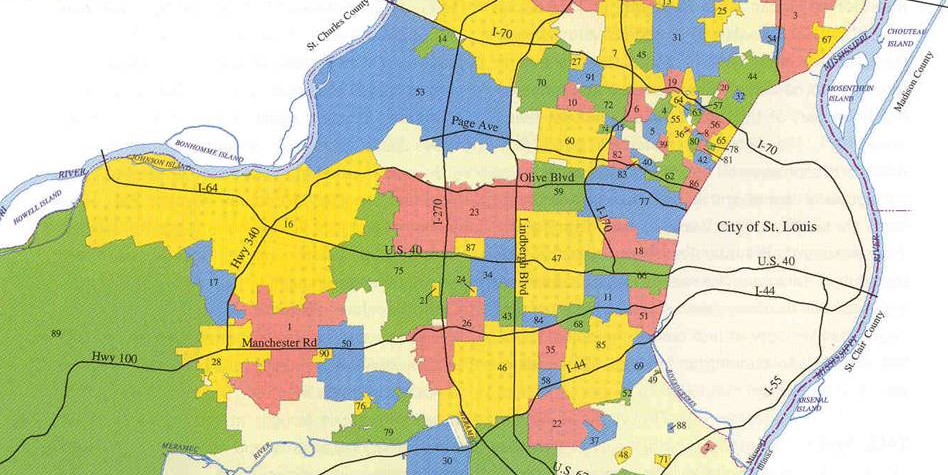

Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc. Where Your Tax Dollars Go. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax.

Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St. This is the total of state and county sales tax rates. The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes.

Click here for a larger sales tax map or here for a sales tax table. 012021 - 032021 - PDF. LOUIS COUNTY tax region see note above Month Combined Tax State Tax.

Due to the ongoing public health crisis the 2021 tax sale will be conducted via sealed bids only. Louis County Collector of Revenues annual tax sale on Monday August 23 2021. The local sales tax rate in st louis county is 2263 and the maximum rate including missouri and city sales taxes is 9988 as of november 2021.

The Missouri sales tax rate is currently. 4225 Average Sales Tax With Local. The County sales tax rate is.

The Missouri state sales tax rate is currently. Louis County Real Property Tax Sale On August 23 2021 Real estate properties with three or more years of delinquent taxes will be offered for auction at the St. You can print a 9679 sales.

Opry Mills Breakfast Restaurants. Louis County Public Safety Sales Tax Quarterly Report 2021 Quarter 1 Beginning Balance 112021 17332761 Revenue Received 11908535 Expenditures Family Court Initiatives 65799 Family Court Pay Program 2020 321341 County. The 2018 United States Supreme Court decision in South Dakota v.

The local sales tax rate in st louis county is 2263 and the maximum rate including missouri and city sales taxes is 9988 as of november 2021. The minimum combined 2022 sales tax rate for Saint Louis Michigan is. Simplify Missouri sales tax compliance.

Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law. 63101 63102 63103. Did South Dakota v.

Soldier For Life Fort Campbell. This table shows the total sales tax rates for all cities and towns in St Louis County including all local taxes. For more information please call 314-615-7865.

Louis Sales Tax is collected by the merchant on all qualifying sales made within St. What is the sales tax rate in Saint Louis Michigan. Raised from 56 to 585 Greentop Novinger Brashear and Green Castle.

To review the rules in. What is the sales tax rate in Saint Louis Missouri. The St Louis County sales tax rate is.

The Saint Louis sales tax rate is. Property owners who are behind in their taxes are encouraged to make payments throughout the year to catch up and keep their property out of the sale. Interactive Tax Map Unlimited Use.

Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. Saint Louis is in the following zip codes. The sales tax jurisdiction name is St.

Missouri has a 4225 sales tax and St Louis County collects an additional 2263 so the minimum sales tax rate in St Louis County is 6488 not including any city or special district taxes. In the circuit court of st. Sales Tax Breakdown Saint Louis Details Saint Louis MO is in Saint Louis County.

State of Minnesota Department of Natural Resources. The following rates apply to the ST. December 2021 8988.

The Saint Louis sales tax rate is. Louis which may refer to a local government division. Tax-forfeited land managed and offered for sale by St.

Due to the ongoing public health crisis the 2021 tax sale will be conducted via sealed bids only. May 24 2022 Published Dates. The Michigan sales tax rate is currently.

Wayfair Inc affect Missouri. The sales tax jurisdiction name is St. Majestic Life Church Service Times.

Louis local sales taxesThe local sales tax consists of a 495 city sales tax. April 19 2022 Published Dates. Are Dental Implants Tax Deductible In Ireland.

November 2021 8. 7906 Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375. Raised from 9475 to 10475.

Louis County Collector of Revenues annual tax sale on Monday August 23 2021. The 2018 United States Supreme Court decision in South Dakota v.

Print Tax Receipts St Louis County Website

Housing Authority Of St Louis County Building Our Communities For Over Sixty Years

Let It Go Time To Disincorporate Municipalities In St Louis County Nextstl

Summer Reading St Louis County Library

Collector Of Revenue St Louis County Website

St Louis Neighborhoods Guide 2022 Best Places To Live In St Louis

Online Payments And Forms St Louis County Website

1967 St Louis Cardinals World Series Ticket Print Vintage Etsy In 2021 Cardinals World Series World Series Tickets Ticket Printing

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Revenue St Louis County Website

2022 Best Places To Live In The St Louis Area Niche

Temp Tags New Missouri Vehicle Sales Tax Law Takes Effect In August Fox 2

What S Living In St Louis Mo Like Moving To St Louis Ultimate Guide